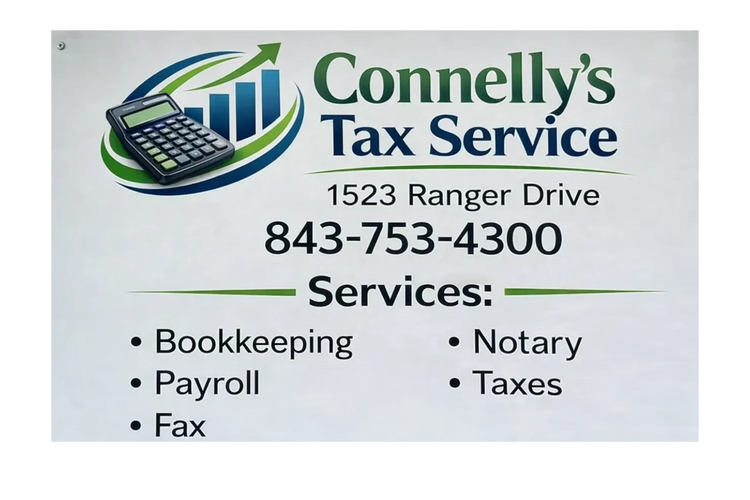

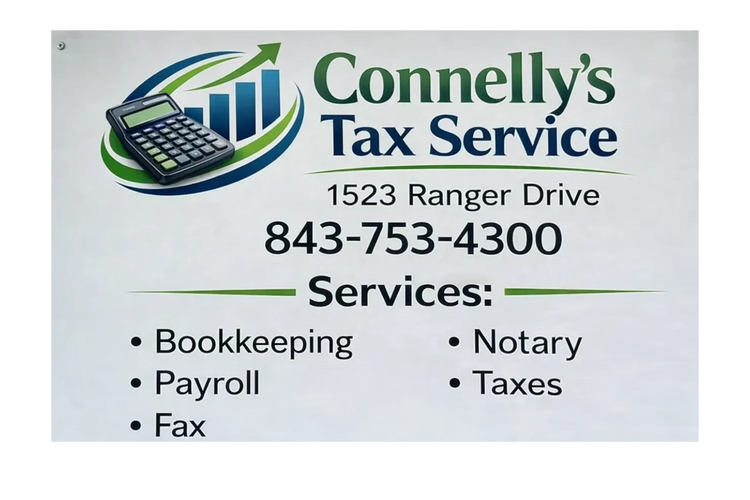

Accounting You Can Count On

Get started with a free consultation!

Signed in as:

filler@godaddy.com

Get started with a free consultation!

New standard deduction amounts are as follows:

Married Filing Joint $31,500

Head of Household $23,625

Single $15,750

Married Filing Separate $15,750

Additional Deduction for 65+ and/or Blind:

Single or HOH + $2,000

Married (per spouse) + $1,600

Both 65+ and blind: Double the applicable amounts

**Big Beautiful Bill Act** created a temporary bonus deduction

(up to $6,000 for seniors age 65+)

Appointment Times Available:

Monday 9-4

Tuesday 9-4

Wednesday 9-4

Thursdays (No in-person appointments)

Fridays 9-4

Saturday 9-4

Closed daily from 12-1 for Lunch

**IMPORTANT DOCS TO BRING**

Be sure to bring all your documents, even if you couldn’t itemize before. The new rules with the

BIG BEAUTIFUL BILL make this especially important!

• W-2 Forms (Due to you by January 31st)

• If you are an employee who gets overtime- PLEASE bring in your last paystub as we will need that

to calculate your overtime credit! (New, due to the Big Beautiful Bill)

• 1099 Forms for misc. income and dividends (1099-MISC and 1099-NEC due to you by January

31st).

• Stocks and Bonds year end statements.

• Charitable Contributions- including clothes, shoes, furniture, as well as taxes on real estate,

property taxes, and any other personal property taxes you may have.

• Bank Routing and Account numbers for refunds/payments.

• Please make sure that we have all current and updated information for you and your

dependents

(phone number, email, mailing address, DOB for new children etc.).

• If you purchased a NEW electric vehicle prior to September 30th, please bring in that

information.

• Tuition Statements- 1098T for yourself and dependents.

• Interest statements from banks and Credit Unions.

• Medical Expenses

• Child Care Statements (please check for provider’s ID number)

• Form 1095A from your Obamacare Insurance Provider

• Statements of Student Loan Interest – 1098E.

The IRS announced that, beginning September 30, 2025, paper refund checks for individual taxpayers

will be phased out- meaning if you receive a refund, it will only be received via direct deposit.

They will no longer issue paper checks.

Although a date has not yet been set, the IRS will also stop accepting checks as payment. You

will have to go online and submit your payments.

If you haven’t already, we strongly encourage all our clients to go online and create an ID.me

account. This account will make it easier for you to access your tax transcripts, notices, as well

as making payments.

I've been in business in Cross since 1991. Prior to that I was in business on James Island with my mother. In my spare time, I love spending time with my dog Lucy, watching chill'em kill'em shows (as my late husband would say), and playing around on the computer

My assistant, Anna as been with me for the last 5 years. She is the mother of 3 kids and recently remarried so outside of work she is pretty busy. If she isn't spending time with her family, you can find her tending to her goats, chickens, and turkeys.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.